If your Aadhaar number isn’t yet linked with PAN card, then every time you login on e-filing portal, you shall be shown a pop-up message asking you to link the Aadhaar number with PAN. Use the link given in the pop-up window to link the Aadhaar with PAN.

Alternatively, you can also follow the following steps to link Aadhaar number with PAN:

- Login to e-filing portal https://www.incometaxindiaefiling.gov.in

Go to ‘Profile Settings’ and click on ‘Link Aadhaar’

Enter your ‘Aadhaar number’, ‘Name as per Aadhaar’ and click on ‘Link Aadhaar’. In case you Aadhaar Card is carrying just year of birth, then you have to check on the option on ‘I have only year of birth in Aadhaar Card’

You are also required to give consent to validate Aadhaar details with UIDAI in order to complete the process of linking.

If the details as per PAN and Aadhaar card are the same, the linking shall be done automatically and a pop-up message will inform you that your Aadhaar card has been successfully linked to your PAN card.

If your PAN is not registered at the e-filing portal, you just need to visit the e-filing portal www.incometaxindiaefiling.gov.in and select the option to ‘Link Aadhaar’ under ‘Quick Links’ section on the homepage. Enter your ‘Aadhaar number’, ‘Name as per Aadhaar’ and click on ‘Link Aadhaar’.

What are the different modes to link Aadhaar Number with PAN?

The government has prescribed the following modes to link Aadhaar number with PAN:

a) SMS:

Send SMS to 567678 or 56161 from your registered mobile number in the following format:

UIDPAN<SPACE><12 Digit Aadhaar Number><SPACE><10 Digit PAN>

For E.g., UIDPAN 123456789000 EPOPE1234E

b) Online:

By visiting the website of the PAN service providers (i.e., www.tin-nsdl.com or www.utiitsl.com). Click on the button ‘Link Aadhaar to PAN’ which will direct you to the income-tax website.

By visiting directly the e-filing website (i.e., www.incometaxindiaefiling.gov.in).

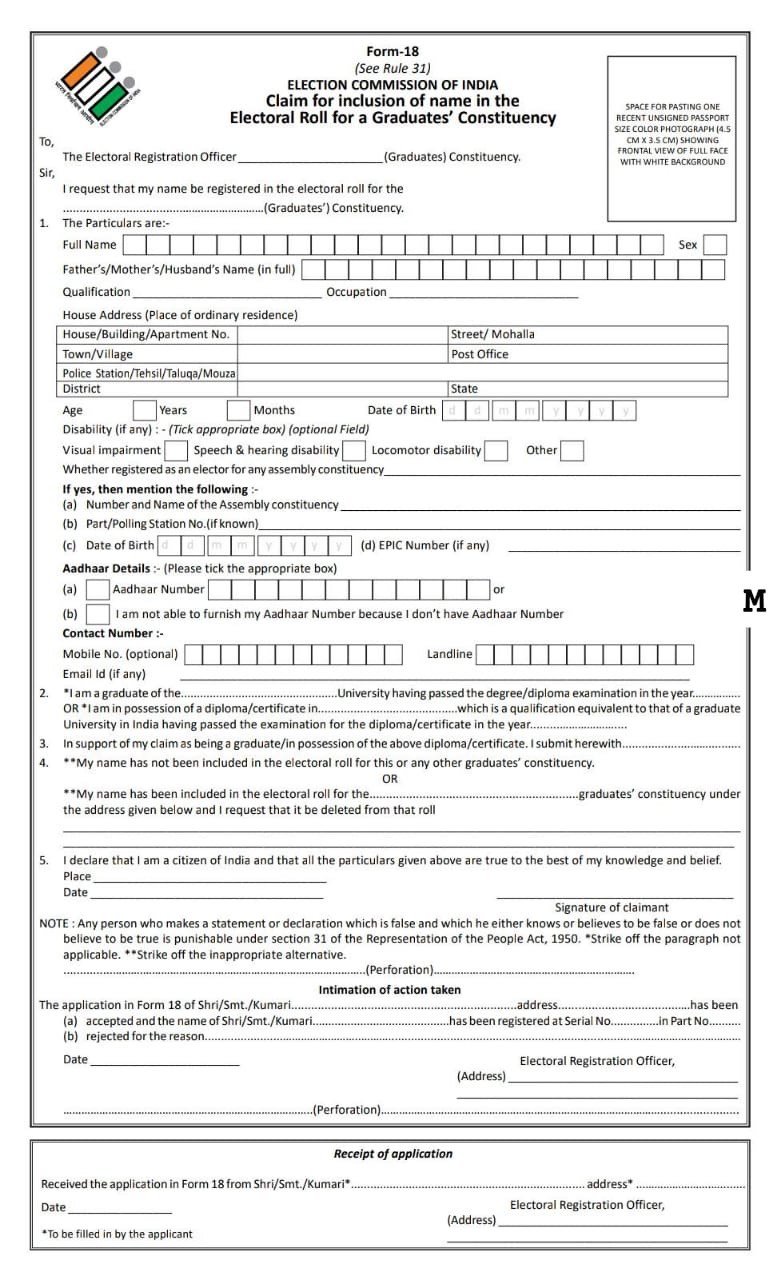

c) Paper mode:

File one page Form along with minimal fee with the designated PAN centre. Copies of PAN card, Aadhaar card are to be furnished.

How to link Aadhaar number with PAN if there is a minor mismatch in the name?

Earlier, the Income-Tax Dept. was allowing linking of Aadhaar number with PAN if there was a minor mismatch in the name appearing in PAN and in Aadhaar card. The identity of taxpayers was verified by sending One Time Password (OTP) to the mobile number registered with UIDAI.

However, with effect from 01-12-2017, UIDAI has discontinued the practice of verifying the user’s identity with OTP. Therefore, Aadhaar number cannot be linked with PAN if there is any mismatch in the name as per records of Aadhaar and PAN. Taxpayers are required to rectify either of the documents, PAN or Aadhaar, so as to complete the process of linking these two records.

What could be other reasons for failure in liking of Aadhaar Number and PAN?

There are certain reasons due to which a taxpayer might not be able to link his Aadhaar number with his PAN. Some of the reasons are:

a) Phone number of the taxpayer is not updated in the Aadhaar database: Taxpayers cannot link their Aadhaar number with PAN if their phone number is not updated in the Aadhaar database. In this case, taxpayers are required to visit the Aadhaar Facilitating Center to update their phone number in the Aadhaar database.

b) Gender Mismatch: In case of gender mismatch, taxpayers won’t be able to link Aadhaar with PAN. In this case, taxpayers are required to get the gender corrected either in Aadhaar database or in PAN database.

c) Date of birth: Aadhaar won’t be linked to PAN in case there is a mismatch in the date of birth of the taxpayer. However, taxpayers whose Aadhaar card contains only the Year of Birth and it matches with the PAN records, linking of these two documents would not be difficult.